Craft Coverage: All About Boat Insurance and Why You Need It

Don’t you just love a good insurance commercial? From Ratt and aunt problems to talking reptiles, celebrity spokesmen, blazing she-sheds and all sorts of other mayhem, ad agencies have put an entertaining spin on the rather dry topic of insurance coverage. Our cars, homes and health can all be insured against unforeseen circumstances. But what about your pride and joy docked at the local marina or private boat slip?

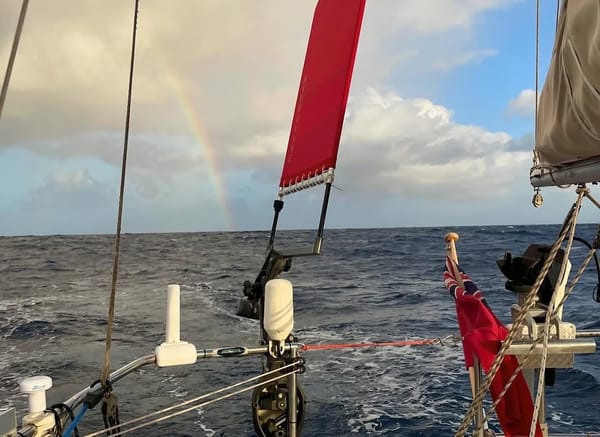

It would be nice if we could just buy a boat and sail off into the wild blue yonder. Alas, though, there’s all sorts of things to consider before hitting the throttle - the biggest of which is probably insurance. Whether you have a yacht, a cat or a schooner, you need to carry an insurance policy for your boat. Just ask Jake from State Farm.

While they may seem like fun sports-related toys, boats are still motorized vessels that can be damaged or cause damage to others. A fire, storm or accident can destroy your whole boat. Without insurance, there’s no way to replace it or get your investment back.

Even if your boat isn’t worth a whole lot, it’s still good (and often required) to have a small coverage plan. In some cases where a state might not require boat insurance, the marina, boat lifts for rent and the bank where you get your loan probably will require it. Even boating events like regattas, poker runs and more may require proper coverage to participate.

Boat insurance companies have seen a thing or two, and they’re on your side to protect you from weather, vandals, breakdowns, marine animals and any other mayhem you may encounter. I, personally, enjoy the jingles and snappy repartee of the onscreen reps. Let’s take a cue from those fun TV ads and discuss just why we need boat insurance.

What Does Boat Insurance Cover?

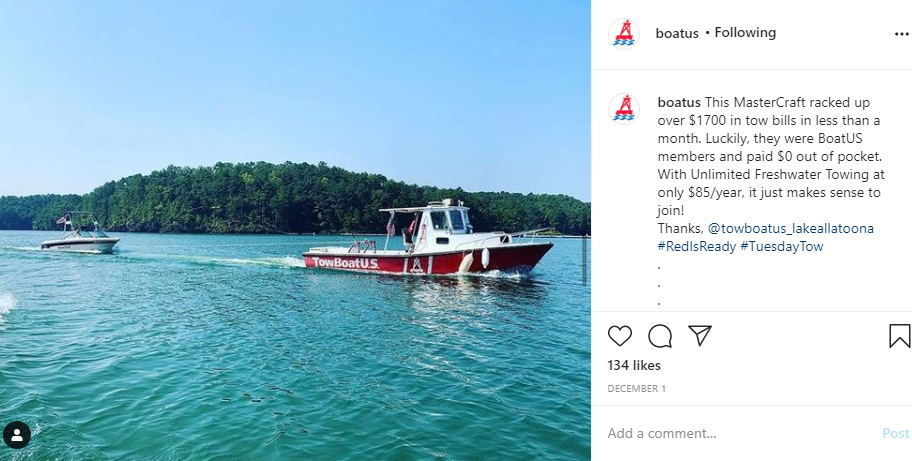

Photo: BoatUS Instagram

Boat insurance policies should include coverage for the boat, including the engine, equipment, trailer and dinghies/tenders. It should also cover medical payments for injuries and liability coverage for damages that you are responsible for. Speaking of trailers, they are not automatically covered, so you’ll want to make sure your trailer is included in your policy.

Some marinas and boat dock rentals require up-to-date liability insurance (whether you carry other insurance or not). This covers the cost of injuries to others or to their property if you are at fault. This is the bare minimum in the insurance world. Liability insurance only covers injury or damage to others. It does not cover damage to your own boat.

Boat insurance covers:

- Coverage for theft, vandalism or damage from the weather

- Emergency towing and labor costs if your boat breaks down in the middle of the lake (this can cost upwards of $400 or more)

- Salvage costs if the boat has to be removed for damages

- Help with getting your boat hauled out of the water in the event of an approaching hurricane

- Elite policies may cover travel outside of the U.S. – such as to the Bahamas or Mexico

- Packages can be tailored especially to certain types of boats such as pontoons, classic and performance boats as well as personal watercraft (jet skis)

- Year-round coverage for damage or theft in storage, at a marina or a private boat slip rental

- Damages due to normal wear and tear like rot or corrosion

Understanding Boat Insurance

Insurance of any kind can be all sorts of confusing when you start reading all the different terms and conditions. Two terms that you do need to understand are “actual cash value” and “agreed value.” Policies are written one way or the other.

Actual Cash Value

Actual cash value means that you pay less up front, but you’ll pay more to have repairs done. For a total loss, your payment is based on the current market value. For a partial loss, you’ll receive the value of the loss minus the depreciation and the deductible.

Agreed Value

Agreed value means that you pay less out of pocket for partial losses, and you know exactly how much you’ll receive in the event of a total loss. If it’s a total loss, you pay an agreed upon value (which you know ahead of time). For a partial loss, it’s subject to the deductible and items will be adjusted for depreciation. For losses on equipment, you’ll receive a new item.

Boat Insurance Providers

Photo: Flo from Progressive via Facebook

Just like car and home insurance, there are a wide variety of insurance companies that cover boats. In fact, you can sometimes add a boat to your homeowner’s policy and get a discount in the process (usually the boat has to be under 16 feet and only applies for use in inland waterways, not the ocean or Gulf). For example, Allstate offers a 20% discount if you add a boat to your homeowner’s policy. They also give a 5% discount for taking a boating education class.

Insurance companies that handle boat coverage include:

- Allstate

- BoatUS (partnered with Geico)

- Farmers

- Nationwide

- Progressive

- State Farm

- Travelers

- U.S. Power Squadron

Factors that can Determine the Cost of Boat Insurance

Photo: Flo from Progressive Facebook

- The length, type, speed and horsepower of the boat

- Age, condition and estimated value of the boat

- Where it will be used (such as lakes, rivers, ocean or Gulf of Mexico)

- Any training or certification of the owner along with their driving and boat operation record

- If the boat is used as a liveaboard or primary residence

A Few Tips

- Taking a boating education class can get you a discount on boat insurance

- It’s cheaper to insure boats used in fresh water as opposed to saltwater

- Having a good vehicle driving record can help with lowering your boat insurance rate

Hopefully you’ve discovered some helpful tips in your search for boat insurance. Whether you go with Flo, join Jake or embark with Brad and Peyton, boat insurance is one thing you don’t want to leave the dock rental without (well, that and snacks – never forget the snacks). Happy boating!